It is tempting to work in Germany, but Slovak companies wishing to do business, second or lease workers there should pay close attention to German law. In this country, mistakes are not forgiven, the authorities are very strict in checking compliance with the rules and are not slow to impose penalties. That is why it is a good idea to have experienced professionals on hand to avoid unnecessary complications or, heaven forbid, penalties.

Germany needs around 400,000 skilled workers from other countries every year to solve its acute labour shortage. This is a great opportunity for Slovak entrepreneurs as well. In recent years, however, the willingness of German companies to hire new people directly has been declining and there is an increasing tendency to lease workers from agencies.

How to get a licence

Employee leasing, also known as Arbeitnehmerüberlassung, allows German companies to borrow labour for a certain period of time according to their current needs. Of course, even in the case of such “leasing”, there are strict rules in Germany non-compliance with which does not pay out.

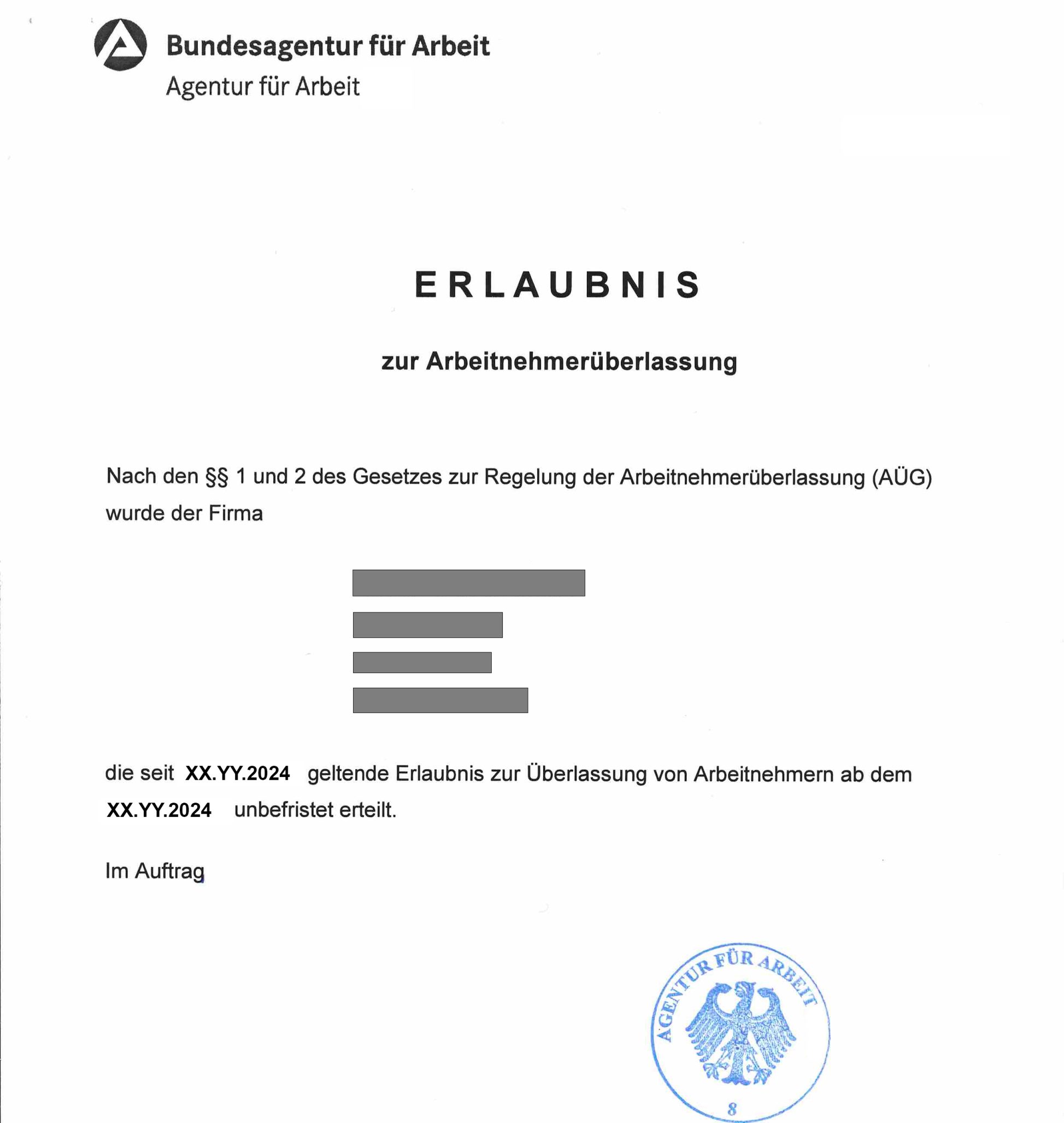

The basic condition to be able to lease workers is to obtain a licence, which is granted by the German Labour Office. If a Slovak entity wishes to obtain a licence for Arbeitnehmerüberlassung, it must have the status of a temporary employment agency granted by the Slovak Central Office of Labour.

Consult the experts

Then, obtaining the licence in Germany itself is a time-consuming and administratively demanding process, and you probably cannot do without the support and consultation of experts who are perfectly familiar with the German labour market environment.

What to observe

Slovak agencies leasing workers to Germany should take into account that in principle they have to provide at least the same working and wage conditions as comparable employees have at their customer’s company. An exception to this principle is the use of a tariff contract in case of the leasing. Agencies are also obliged to pay payroll tax to the German tax office from the first day of leasing an employee. Slovak companies leasing workers therefore need to have a German tax advisor who will process the hired employees’ payroll and then the company will pay the payroll tax for them at the local tax office. We at ProfiDeCon, of course, not only have a dependable team of tax specialists in Germany, but also specialists in the field of employment law.

Germany has strict legislation on labour law and the protection of employees’ rights. The labour authorities here carry out regular checks on compliance with this legislation. Violations are punishable by heavy fines and other unpleasant consequences, up to and including prohibition of activities. ProfiDeCon is a specialist in advising on leasing labour to Germany and has extensive experience in advising on compliance with local legislation. We will advise you too and make sure everything is in place so you can focus on your own, hassle-free business.